Asset Turnover Ratio Standard

State Street Real Asset Non-Lending Series Fund Class A Class A represents units of ownership in. Inventory Turnover Ratio Cost of Goods Sold Avg.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets.

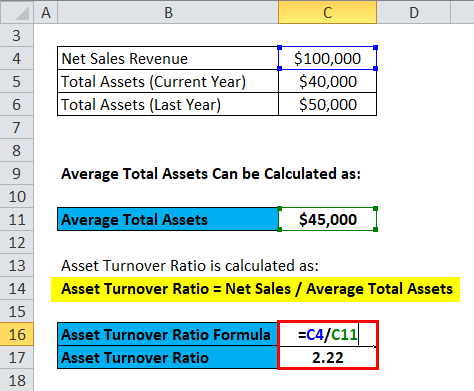

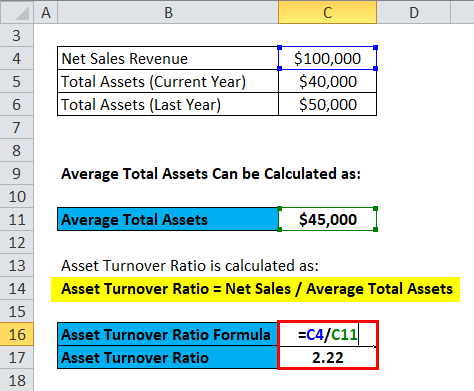

. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product. Asset Turnover Ratio Net Sales Average Total Assets. The standard asset turnover ratio considers all asset classes including current assets long-term assets and other assets.

Asset turnover days 815. Asset Turnover Ratio 100000 25000. Total Asset Turnover Revenue Average Total Assets Fixed Asset Turnover.

This ratio is used to measure the number of times the business is paying off its creditors or suppliers in an accounting period. Compare your days in accounts payable to supplier terms of repayment. The higher the ratio the better is the companys.

Receivables turnover days. Search Quotes News Mutual Fund NAVs. Total Assets A common variation of the asset turnover ratio is.

A low turnover may be a sign of cash flow problems. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue. If sold after 1 year from purchase date long term capital gain tax will be applicable.

Likewise companies having too high a current ratio relative to the industry standard suggests that they are using. Both of these metrics are based on. Higher turnover in a stock indicates better liquidity which means that it is easier to sell the stock in the market.

2021 2020 2019 2018 2017 2016. There are five types of financial ratio. A high turnover may indicate unfavourable supplier repayment terms.

Cherry Woods Furniture is a specialized supplier of high-end handmade dining sets made from specialty woods. This ratio is used as a guide to optimising the firms assets inventory and accounts receivable collection on a regular basis. What is an Expense Ratio.

Each companys financial statements look different so we have done a lot of work to convert them to the standard form according to the latest US. Apple Inc Balance sheet Explanation. Asset Turnover Ratio 4.

Portfolio Turnover Ratio. Over Q3 its busiest period the retailer posted 47000 in COGS and 16000 in average inventory. Asset Turnover Ratio is calculated as.

To calculate your accounts receivable turnover ratio divide your net sales by your average gross receivables. Including total net assets of a fund expense ratio and the current net asset value of the fund. By standard deviation similar to longer-dated US.

Calculating Accounts Receivable Turnover. In other words measures the percentage of your investment in the fund that goes to paying management fees by comparing the mutual fund management fees with your total assets in the fund. Turnover can be represented in two ways traded value in rupees and traded volume in number of trades.

It is calculated consistent with Form N-1A by. The higher the turnover the shorter the period between purchases and payment. Trade payables turnover ratio or Accounts payable turnover ratio depicts the efficiency with which the business makes payment.

Inventory Turnover Ratio Examples. Current tax rate is 10 if your total long term capital gain exceeds 1 lakh. To find the inventory turnover ratio.

This indicates that for company X every dollar invested in assets generates 4. TIPS over the long term. Accounts payables are short term debts that a business owes to its suppliers and creditors.

The formula for a stock turnover ratio can be derived by using the following steps. 3 Right-of-use asset that meets the definition of investment property IP are required to be presented as IP in the BS. Types of Financial Ratios.

Market turnover indicates how much trading activity took place on a given business day in the market as a whole or individual stock. The expense ratio is an efficiency ratio that calculates management expenses as a percentage of total funds invested in a mutual fund. The portfolio turnover rate is as-of the prior fiscal year-end FYE.

Dividend Payout Ratio Standard Deviation Compound Annual Growth Rate CAGR Discounted Cash Flow. This suggested that the company was using its assets more efficiently as compared to the industry for generating sales. Thus asset turnover ratio can be a determinant of a companys performance.

2 Virtually all leases will be capitalised except for exempted short-term leases and low value asset leases. The two common assets are. Analyze the Fund Fidelity Asset Manager 50 having Symbol FASMX for type mutual-funds and perform research on other mutual funds.

Both fixed asset as well as total asset turnover ratio for Motorola was higher than the industry average. A ratio may serve as an indicator red flag or clue for various issues. A standard yield calculation.

Allocation--50 to 70 Equity. Under the new standard other accounting changes include accounting for sub-leases lease modifications and.

Asset Turnover Ratio Formula Calculator Excel Template

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Asset Turnover Ratio Formula Calculator Excel Template

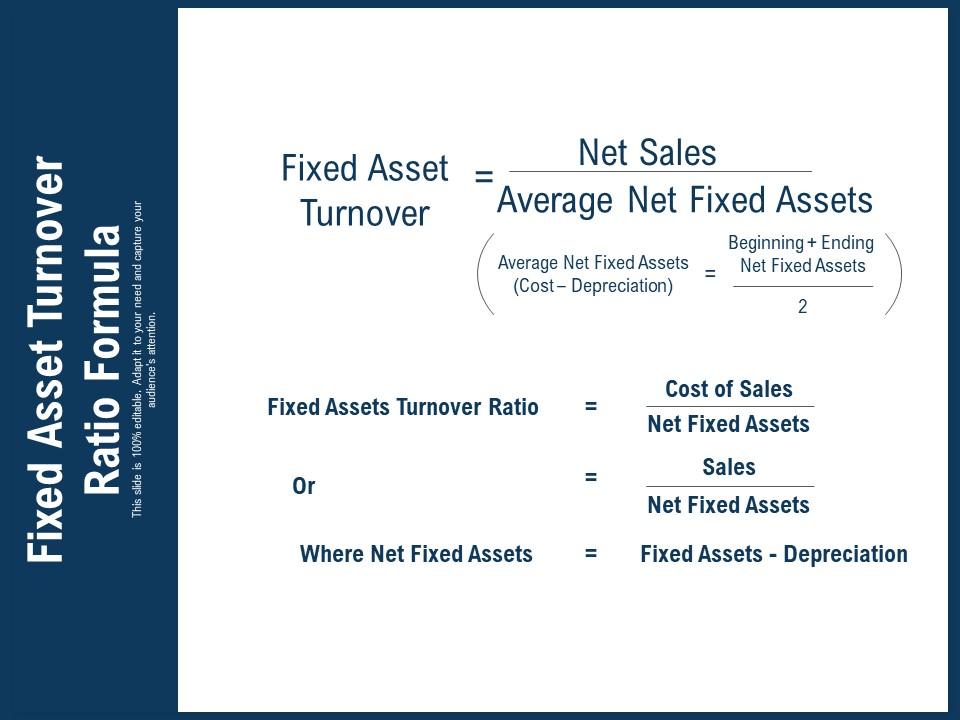

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

0 Response to "Asset Turnover Ratio Standard"

Post a Comment